Treasury Is the Most Underrated Team in Your Company

Treasury teams are powerful functions with the ability to influence all the levers of shareholder returns. Yet, often such teams are structured, staffed, and incentivized poorly.

This article was originally published on Toptal

I began my career working in a bank’s treasury team, and it provided a fantastic basis of financial education that has direct influence over all manner of work that I do now. Through reasons that I will explain in this article about treasury management best practices, such teams are pivotal to the success of their organizations, yet are often misunderstood or underestimated. I have regularly had to explain (courteously) that corporate treasury is not centered around wooden chests, nor whip-rounds for group holiday cash.

What Is Treasury Management?

Treasuries are the custodians of cash in a business, they control this through 1) the amount held and 2) its liquidity. The two levers of this are through the sheer size of the balance sheet and the relative stickiness (liquidity) of assets and liabilities held. Their management of this enables the basic fundamentals of an organization: allowing teams to operate and conduct activities by ensuring that there is cash on hand, be it in the petty cash box or an opportunistic M&A raid.

In addition to enabling business-as-usual (BAU) activities, treasuries partake in the macro-financial direction of a company and oversee the execution of company-wide strategies. For example, if the board decides to buy a business or expand into new territories, Treasury will help to determine the fit of the company from a balance sheet perspective and find the cash (or issue stock) to purchase it ultimately.

By actively managing liquidity, treasuries ensure that businesses stay alive, save money, and can respond quickly to change.

Areas Covered by a Treasury

The basics of treasury management can be distilled into five critical responsibilities.

ASSET LIABILITY MANAGEMENT (ALM)

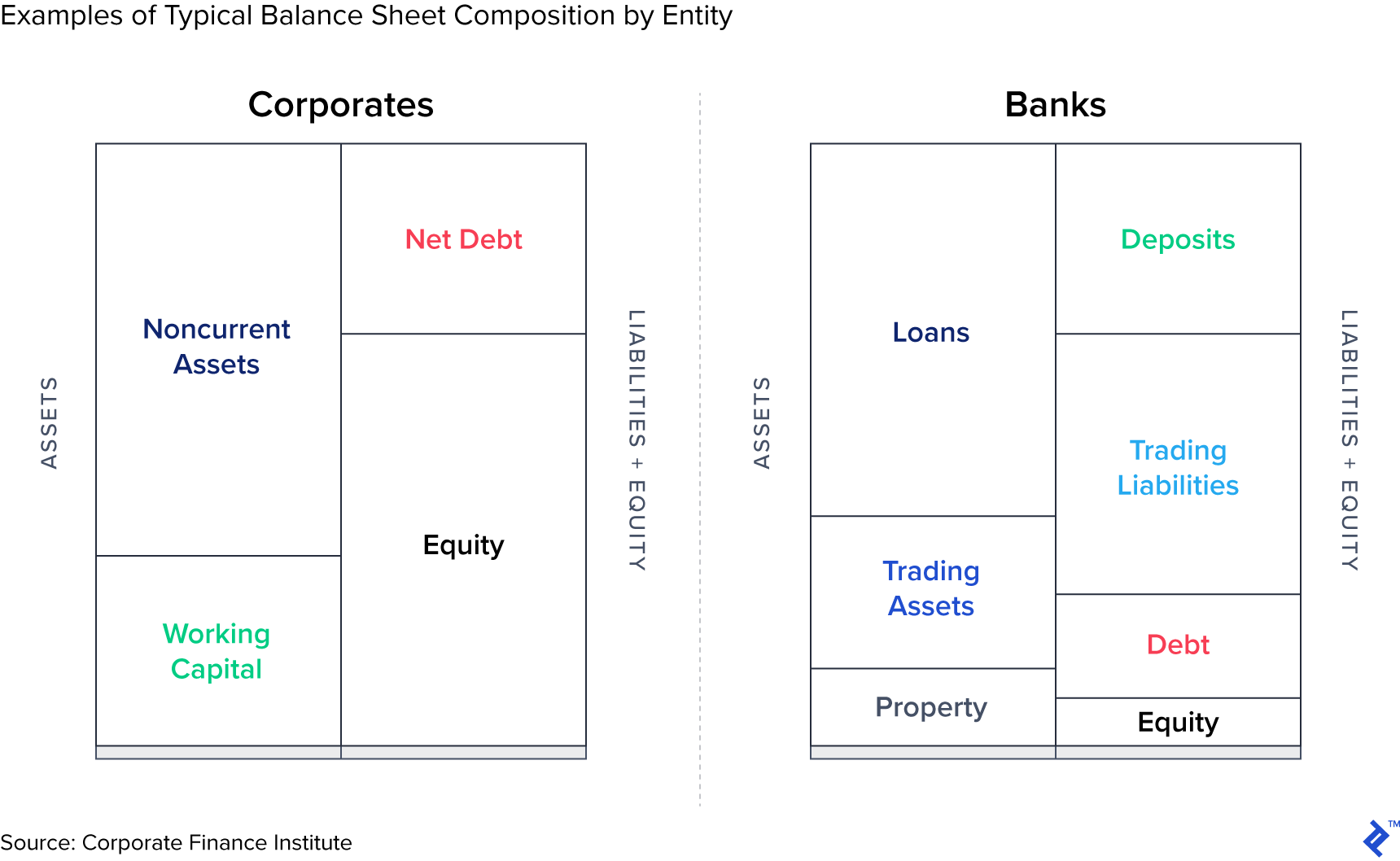

ALM concerns the blend of assets and liabilities that sit on a balance sheet and the subsequent mismatches between tenor, currency, and interest rate (cost). Companies hold a range of instruments on balance sheets, which behave with varying characteristics. How they interact with each other and represent the overall position could be metaphorically described as being similar to the concept of Beta in portfolio management.

ALM is most relevant for treasury management in banks because their fundamental purpose is based upon the gearing dynamic of borrowing and lending money. The graphic below demonstrates generic balance sheet compositions for corporates and banks and, as you can see, banks are generally more leveraged through their increased use of liabilities relative to equity capital.

Because it’s generally cheaper to borrow short-term liabilities and invest in long-term assets, there is a natural tendency for companies to stretch this funding mismatch to a limit. This can all come crashing down during market flashpoints when credit dries up and liabilities become harder to roll. An ALM function monitors this liquidity horizon, prescribing limit buffers and advising on any changes that can be observed in advance.

Optimizing assets and liabilities in a proactive manner increases profitability and business opportunities. This is not just in the domain of banks; here are some examples of companies using treasury management to assist business:

- Direct to consumer vendors (e.g., supermarkets, eCommerce) that have negative cash conversion cycles and offer consumer credit services.

- Share repurchase schemes enacted at opportunistic periods.

- Factoring receivables to gain a competitive advantage by winning new customers with attractive payment terms.

FUNDS TRANSFER PRICING (FTP)

Treasuries are mini-banks for their own companies (or banks) and must price up the liabilities on hand for use in everyday asset-generating activities. The FTP reflects the cost of liabilities and is charged to a business unit when it wishes to originate a new asset. Unlike the widely-known cost of debt figure, which can be represented as a standalone loan or benchmark bond yield, the FTP represents a fully-loaded cost. By that, I mean that it is the overall weighted average cost of all liabilities plus the internally shared costs of the business minus treasury profit.

Funds-transfer pricing is the process of costing a balance sheet and then setting the requisite prices for asset creators or liability gatherers to pay or earn for their respective tasks. Without this, there would be a free-for-all, with profitability and balance sheet structure left to its own devices.

TRADING AND HEDGING

The responsibilities of hedging company-wide interest rate and FX risk sits with the treasury function, who will use derivatives to balance the books. Depending on the sophistication of the business, these risk management strategies can range up from FX spot trades to long-term interest rate swaps.

For example, I worked at a bank with predominantly GBP-based liabilities, but with assets written in EUR. A sudden change in either currency would distort the risk, in terms of the proportions of the balance sheet and the relative profitability of deals. To counteract this, we would trade cross-currency swap derivatives to “crystalize” the asset positions into GBP to retain parity.

PORTFOLIO MANAGEMENT

Treasuries are financial asset managers for their company, investing spare cash that sits on the balance sheet to generate a return (and thus, lower FTP). This is often a very creative exercise that involves the search for yield, liquidity, and capital efficiency. Braeburn Capital, for example, is the asset management arm of Apple, a company that regularly has reserve treasury funds of over $200 billion!

INTEGRATION/PROJECTS

Overseeing all parts of the business and being agnostic towards any specific business line will usually put the treasury as a useful tool for integrating acquisitions into the company, or for spearheading IT transformation initiatives.

Treasuries Cover All the Bases

My main argument for treasuries being underrated in organizations is because I see them as being in charge of all mechanisms that drive financial returns. As such, if managed correctly, they can be a flexible and significant contributor to financial performance.

Headline attention on business performance does tend towards the income statement side, in terms of revenue growth and profitability. Yet if we take a step back, the core (capitalist) purpose of a business is to provide returns to its shareholders, of which return on equity (ROE) is the standard metric. If we deconstruct ROE into its constituents using the DuPont Analysis formula, it becomes apparent that the role of a treasury touches every aspect of it.

If we look further into these components, we can see the broad role that treasury contributes:

- Net Profit Margin (Profit/Sales): Searching for cheaper borrowing costs increases contribution margin = more competitive

- Asset Turnover (Sales/Assets): Getting more yield out of assets through ALM and portfolio management = more revenue

- Financial Leverage (Assets/Equity): Managing debt to optimal levels = more opportunities

Outside of the C-suite, there are very few teams in a company that can cover all of these bases. Yet, the unheralded treasury team does and thus, if operated correctly, can be a real asset to the company.

Treasury Management Best Practices

Broadly speaking, from my experiences, treasuries are underutilized due to them being too reactive and on tunnel vision to follow set processes without the autonomy to be flexible. Below are my treasury management best practices for how to build and operate a capable team, for the benefit of the whole business.

1. Structure and Compensation

Starting right at the top, a business must place its treasury in the correct area of the organization. An effective team must be:

- Impartial: Not allied or biased toward any commercial area of the business

- Empowered: Both in terms of human and capital resources and flexibility to “roam”

- Incentivized: In the absence of being a profit center, team members must have quantifiable goals.

Too many companies fail by having treasuries as operational offshoots of teams like accounting, working out of a back cupboard in the suburbs. Instead, they should report to the CFO directly and be relied upon as lieutenants in the business for their insight into the balance sheet. Similarly, all roles and functions should be contained within the same team. Trying to create a “cloud team” with roles scattered among the company will ultimately result in crossed wires and less effectiveness.

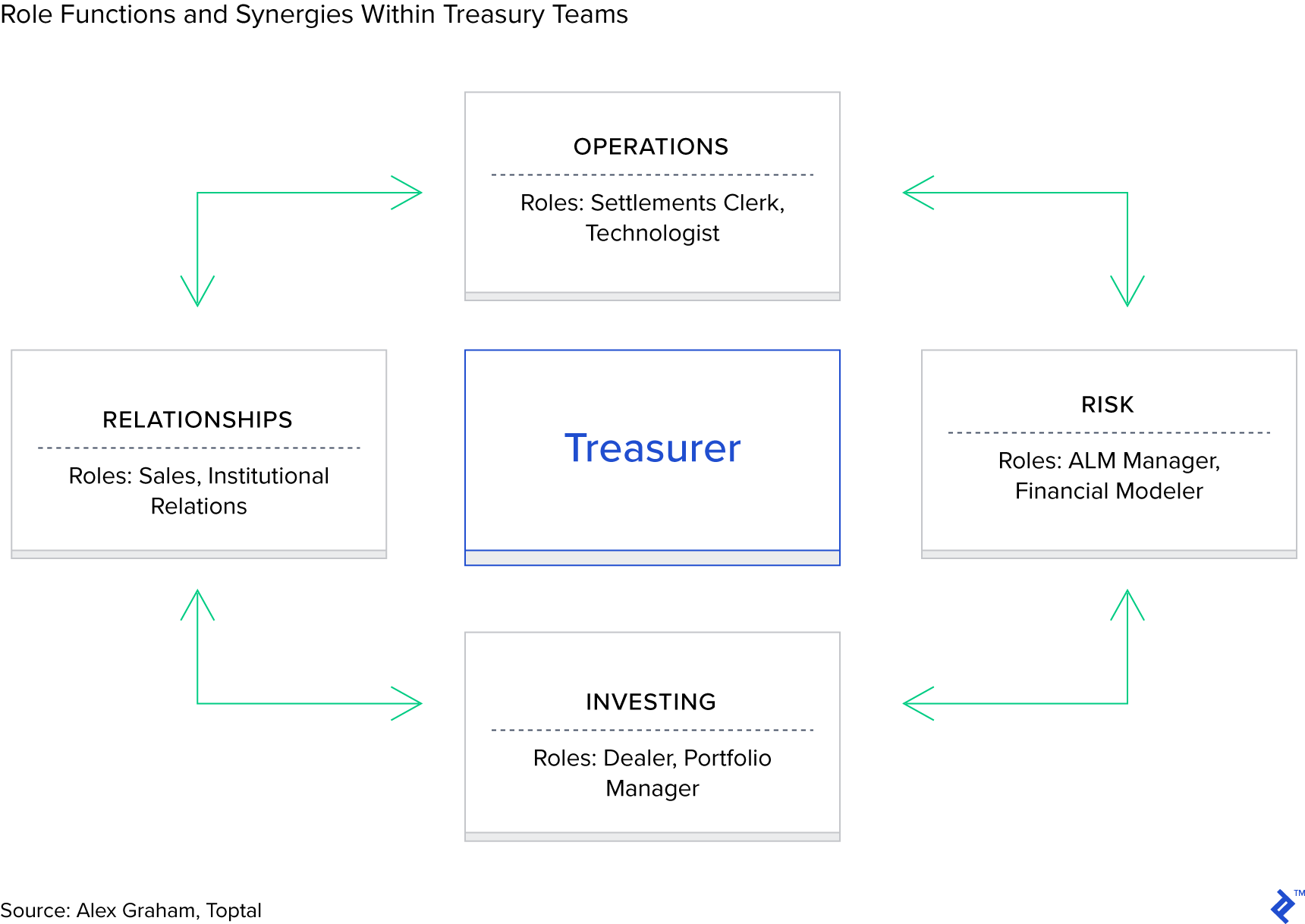

Below is my recommendation for key functional roles and focus within treasury teams.

To give an example of why it’s important to contain all of these roles in the same team, here is a simple example of the four pillars working together:

- Operations notices that terms on a lease have been incorrectly interpreted and it’s actually longer.

- Risk models up the effect of the longer asset life and confirms that liquidity horizons have shortened, due to shorter-dated borrowing.

- Relationship managers canvas banking contacts and find a willing lender for a revolving credit facility.

- The investing team drawdowns the loan, using an FX swap to convert a portion to cover short-term requirements.

AGENCY COSTS OF INCENTIVES

It’s also important from a performance mindset to get compensation and incentives right. This comes optically from how the team is created and to literally where they are seated in the office. Treasuries interface externally, and thus must project confidence and the corporate image to external parties.

Because the team is not a profit center (profits flow to the central company entity), there can be perverse incentives. For example, taking an ultra high-risk policy of raising long-dated cash and lending it out short term is not a commercially sound practice, outside of severe market stress. But, if the treasury team is not incentivized, they may indeed take this option, because it’s safe and they will get paid regardless. Equally so, because the P&L is just swallowed by the company and performance is not related to it, this can lead to best execution policies going out the door.

Establishing suitable and compelling incentives for treasury staff reduces agency costs. I believe that variable compensation related to FTP movement is an interesting tool for measuring holistic team performance.

2. Get FTP Right

Costing up a balance sheet is an arduous task and one that can become difficult if there is a high turnover of items and/or weak IT treasury management systems. Getting it right, though, will ensure that new business activities using the balance sheet are value-additive by ensuring that the mentality of fully-loaded margin is the minds of business units.

In doing this, having an agreed-upon floating interest rate benchmark (like what LIBOR used to be used for) for the whole company is the best method for pricing up FTP. This removes arbitrage opportunities, interest rate curve risk, and also makes things a lot easier for the ALM team’s monitoring.

It’s also worth mentioning that FTP should be disassociated from credit risk. Pricing deals should be done on a case-by-case basis by credit/deal teams with counterparties scored for risk and then charged appropriately on top of FTP. This further establishes the agnostic nature of a treasury towards the business: the team is an enabler, not an arbitrator.

3. Communicate Effectively

As the ears to the financial markets and the straddlers of the balance sheet, the treasury management function is an important news source for the company. It should translate macroeconomic events into resultant risks, or conversely, opportunities. Instead of forwarding information on, such intel should be packaged as actionable insights: “How does this affect our company?”

Reporting the cash position of a business is a vital end-of-day reporting task, but it should not stop there. Reporting to the executive committee should be communicated in a concise manner, and not just a dump of mundane reports.

When reporting data, focus on key metrics to give a snapshot of:

- Liquidity Horizon: How long you will survive if liabilities stopped rolling

- FTP Cost

- Weighted Average Yield: Earned on assets under your control

- Value at Risk (VAR): Of assets and derivative positions

Using a traffic light system helps to give relativity and emphasize urgency. Equally as important is to give commentary to the data to explain qualitatively why has something changed.

4. Shop Around

Treasuries are buy-side institutions; they need market makers to provide them with financial products ranging from vanilla deposit accounts up to esoteric derivatives. The key mistake I regularly see here is when a team does not properly shop around and have a wide bench of liquidity providers. Usually, the dealer sticks to a couple of providers, either because they are not proactive enough and/or enjoy the client entertainment that their wide spreads are unwittingly paying for.

As a footnote to the above, a treasury should interact directly with the market. Going through other teams within the same company is an exercise of P&L pass the parcel and breeds inefficiency.

An effective treasury should manage external clients in the same way that a sales-focussed SaaS startup would. Maintain a CRM with links into banks, brokers, and funds with rankings of their pros and cons. This will ensure that competitive pricing is achieved and that there is a large phonebook of liquidity providers for when markets go south.

Electronic trading platforms are great for getting good comparisons on pricing, saving time, and measuring execution performance.

5. Don’t Be a Hero

The investment portfolios that treasuries manage are the equivalent of the change that you keep in a jar by your front door. This money is money that is left in the pile every day that is not being used. It is white-hot and could be deployed the next day. Investing it is important, though, because the yield gained lowers the dead-weight loss of undeployed capital and can bring tangential hedging and counterparty relationship benefits.

The three pillars of treasury portfolio management are liquidity, risk, and capital efficiency. These conservative targets are different from most other portfolio managers (notice the absence of yield) and might seem boring to some, but it actually gets quite interesting in the way that you can employ certain instruments in cash management strategies. Yield is an optional fourth choice, but my view is that the opportunity cost of not investing is 0%, thus any yield (positive) is immediately a success.

I remember poring over Basel III capital rule requirements, at matrices of bond types vs. credit ratings, looking for the highest yielding instrument that would comply with the lowest treasury risk weighting for my bank. For a couple of months in 2012, I became an expert on unloved Slovenian government bonds due to their high yield, yet efficient credit ratings.

The point is though that no-one will remember the Treasurer that earned a humble 50bp of yield on their investment portfolio, but everyone, including the press, will remember the London Whale who lost $6.2 billion. So don’t be a hero with the cash management process of the liquidity portfolio.

6. Build an ERP and Take the Time to Get It Right

Treasurers are blind without effective software to splice up the balance sheet and communicate liquidity positions and risk exposures. Money moves by the second and if you are not ahead of this, then you will be chasing shadows trying to reconcile positions. Treasuries need systems that can account for a full range of functionality, the fewer systems the better for ensuring smooth crossover of workflows.

Treasury software is notoriously difficult to get right. Pre-packaged solutions come with promises but then require constant tweaking to ensure that internal trades and movements get captured. Oftentimes the ERP is a derivative of a trading platform or accountancy ledger software, which can mean that treasury functionality is a compromised add-on.

Internally-built software can be tailor-made but becomes a mid-term engineering task, my advice is to invest in getting it right and starting from a clean slate. The concept of artificial intelligence seems almost tailor-made for applications in predicting treasury cash flows. This is one big reason why I can see new fintech neobanks having an increasing competitive edge as they scale.

7. Lead Inside the Organization

A treasury function has the platform of being able to emphasize with asset and liability focused teams, acting as counsel between the two. In banks, this is the deposit takers and lenders, but in a corporate, it could be the property team vs. the payables department.

Being impartial and involved with the business units and providing solutions over roadblocks will ultimately help the wider organization and increase buy-in.

A Side Note for Treasury in Fintech

Fintech organizations occupy an interesting niche. They are often at pains to highlight that they do things differently and distance themselves from the incumbents they’re looking to disrupt. One manifestation I see of this trait is the higher emphasis (albeit justified) on technology and marketing, which often leaves treasury relegated to a role in a sprawling function that’s often just named “finance.”

Some general tips for fintechs in this regard:

- Ensure that the first CFO can comfortably wear the “capital markets” hat and the “bookkeeper” hat. This keeps staffing efficient and maintains zen within the financial culture of the startup.

- Get the CTO on board quickly for committing towards a stable roadmap for backend technology. Having a beautiful customer-facing app, but an Excel-based Medusa of an ERP function is a recipe for disaster.

- Focus quickly on building external counterparty relationships. Banks and traditional financial intermediaries may shut the door to a fintech if it fears disruption. The use of partnerships and the magic brand dust of being associated with a fintech can alleviate this, in addition to strategic equity investment partners.

- Tier 2 (“mid market”) banks can be useful allies here, as they are chasing market share and differentiation gains against the entrenched elite.

- Leverage personal links from your VC and angel investors. When a bank smells a future IPO payday, it will offer concessionary services as a way to establish an early relationship and ultimately win capital markets mandates down the line.

- Incorporate pricing analysts into the front and back office. Many fintechs, for example, offer margin-free FX transactions. If this is a straight pass-through of rates achieved from wholesale providers, then that’s fine. But if the company is losing money on these transactions, the cost must be referenced in the overall marketing CAC. Leaving this as the problem of the treasury will result in unrealistic expectations about the unit economics of the business.

Sail the Balance Sheet Ship

For those considering their company’s treasury management function or others considering a career in the area, I often give them these pointers towards its importance in business, in terms of:

- Learning to use the balance sheet as a ship’s sail for driving business growth

- Isolating the effects of real-world events into which parts of the business they effect

- Working toward a macro business goal instead of a micro team P&L

Getting this right will ensure that you have a robust balance sheet that can eke out the marginal gains required to compete in a rapidly-changing and responsive business world.